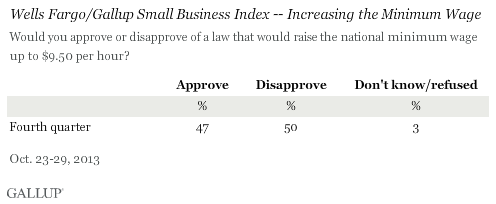

WASHINGTON, D.C. -- Small-business owners are divided about raising the national minimum wage to $9.50 an hour from its current $7.25. Forty-seven percent would approve of a law that would do this, while 50% would disapprove.

These results come from the fourth-quarter update of the Wells Fargo/Gallup Small Business Index, which is based on telephone interviews with 605 small-business owners from Oct. 23-29. The 47% of small-business owners who now approve of a $9.50 minimum wage is similar to the 46% of small-business owners who supported raising the minimum wage in 2006 -- though that question did not provide a specific wage value. The remaining half of small-business owners in 2006 believed the minimum wage, which at the time was $5.15 per hour, should either be kept at the same level, reduced, or abolished entirely.

While support for a $9.50 minimum wage is decidedly mixed in the business community, the U.S. public strongly supports such a move, with 76% approving of raising the minimum wage to $9 an hour. More generally, the public has supported raising the minimum wage in Gallup surveys for decades.

Small-Business Owners Believe Wage Increase Hurts Business, Helps Employees

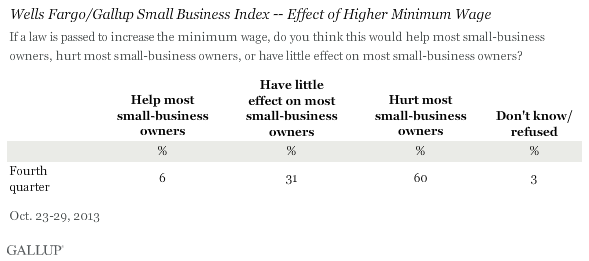

If policymakers pass a law to increase the minimum wage -- as Democrats in the Senate have expressed support for -- six in 10 small-business owners believe it will "hurt most small-business owners." Another 31% believe it will have little effect on this business community, while 6% believe it will actually help small-business owners.

A plurality of business owners acknowledge that any increase in the minimum wage is likely to benefit employees of small businesses (41%). However, 24% of small-business owners say the increase would have little effect on small-business employees, and one-third say upping the minimum wage would hurt small-business employees -- presumably because of the potential of the raise spurring layoffs, benefit reductions, or reduced hours.

Minimum Wage Increase Largely Would Not Affect Business Operations

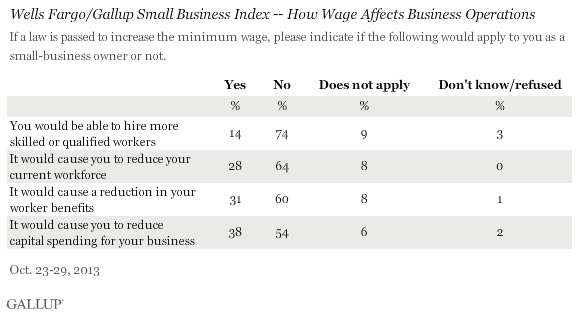

While most small-business owners foresee a minimum wage increase harming most small business, when looking at possible ramifications of a higher minimum wage, such as reduced workforces or workers' benefits, majorities of small-business owners do not anticipate making such changes. Still, 28% of small-business owners say increasing the minimum wage would cause them to reduce their current workforce. A similar 31% say the wage increase would cause a reduction in worker benefits, and 38% say it would cause them to reduce capital spending for their business.

In total, 45% of small-business owners say an increased minimum wage would cause them to either reduce their workforce, reduce worker benefits, or reduce capital spending, or some combination thereof. Meanwhile, three-quarters of small-business owners (74%) do not believe they could hire more skilled or qualified workers as a result of the base-pay increase.

Bottom Line

Increasing the minimum wage is popular among the populace, but more divisive among small-business owners interviewed as part of the fourth-quarter Wells Fargo/Gallup Small Business Index. Small-business owners, generally speaking, fear a minimum wage increase will harm small businesses, and almost half of these business owners expect that an increase would cause them to reduce their workforce, worker benefits, capital outlays, or some combination thereof.

About the Wells-Fargo Small Business Index

Since August 2003, the Wells Fargo/Gallup Small Business Index has surveyed small-business owners on current and future perceptions of their business financial situations. Visit the Wells Fargo Business Insight Resource Center to access the full survey report and listen to Wells Fargo's quarterly Small Business Index podcast.

Survey Methods

Results for the total data set are based on telephone interviews conducted Oct. 23-29, 2013, with a random sample of 605 small-business owners, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of small-business owners, one can say with 95% confidence that the margin of sampling error is ±4 percentage points.

Sampling is done on a random-digit-dial basis using Dun & Bradstreet sampling of small businesses having $20 million or less in sales or revenues. The data are weighted to be representative of U.S. small businesses within this size range nationwide.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit www.gallup.com.