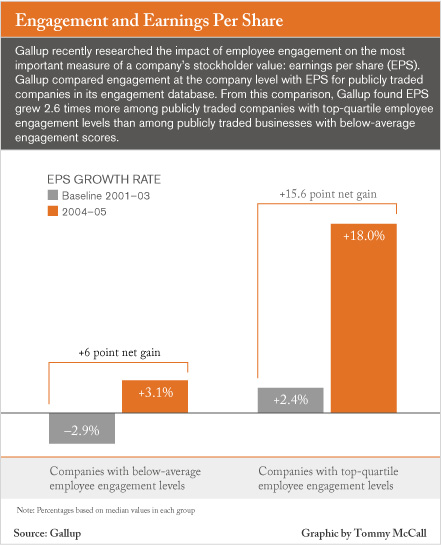

When deciding where to put their money, do investors take into account the engagement level of a company's employees? If not, it's time they did. Gallup research has found that higher workplace engagement predicts higher earnings per share among publicly traded businesses.

When compared with industry competitors at the company level, organizations with more than four engaged employees for every one actively disengaged employee saw 2.6 times more growth in earnings per share than did organizations with a ratio of slightly less than one engaged worker for every one actively disengaged employee. (See graphic "Engagement and Earnings Per Share.")

|

Of course, not every investor who feels secure putting his or her money in a publicly traded stalwart of the financial banking industry would also buy into an up-and-coming biotech company, and vice versa. That's because no two industries are exactly the same. So to control for fluctuating circumstances particular to specific industries, Gallup scientists controlled the study at the company level. The results show that in addition to growing faster than below-average-engagement organizations, earnings per share for top-quartile organizations outpaced earnings per share for their competitors by 18% during the study period.

Effect on returns

Gallup has studied employee engagement -- employees' involvement in and enthusiasm for their work -- and its effect on individual and organizational workplace performance outcomes, such as customer advocacy, productivity, profitability, turnover, absenteeism, safety, and inventory shrinkage -- for more than 40 years. To study the impact of engagement on companies' share prices, Gallup researchers conducted an exhaustive exploration of both the workplace engagement database and comparable publicly traded competitors to control for variables at the company level throughout different industries. Jim Asplund, Gallup's chief scientist of strengths-based development, sifted through the resources to develop an accurate representation of publicly traded organizations and their financial data during the baseline and study timelines.

|

"The first task was determining which companies from the database we could get public financial data about," says Asplund, coauthor of a book on employee and customer engagement, Human Sigma: Managing the Employee-Customer Encounter. He was able to identify about 90 organizations that were publicly traded in an exchange somewhere in the world and that also met the following criteria, which Gallup devised to ensure an accurate study:

- The entire organization must have conducted a Q12 employee engagement survey. This criterion was necessary for Gallup to make accurate comparisons at the company level.

- Public financial data must have been available for each company for the years covered by the research, including the baseline (2001-2003) and study (2004-2005) timelines.

Once researchers had identified the organizations in the employee engagement database that met these criteria, they determined which of their competitors had comparable public data available in each industry and which of those industry peers to include in the study. "A lot of the process involved accounting; we had to track down the relevant financial data and also find the right set of comparable companies to include in the survey," Asplund says.

One way to control for the variability in differing industries is to compare each company to its competition. "Also, earnings per share can really bounce around. So we looked at patterns across time for the organizations in our study," says Jim Harter, Gallup's chief scientist for workplace engagement and well-being. "By combining similar companies and coupling their data across a longer period of time, we can better understand the true patterns across highly engaged and less engaged organizations."

The frequency of Q12 survey administrations and the amount of experience organizations have with Gallup's workplace engagement practice also affect results. Top-quartile companies averaged nearly three administrations of the Q12 survey, compared with an average of just slightly more than one Q12 survey administration by the below-average companies. However, even with fewer administrations of the survey, earnings per share for below-average companies rose from the baseline measurement (2001-2003) to 2004-2005.

Beyond return on investment

This research doesn't show investors and business leaders exactly what organizations are doing on a day-to-day basis to develop engaged employees, but the findings do draw connections to a highly visible outcome. In addition to demonstrating differences in overall performance between companies, Gallup's meta-analyses present strong evidence that highly engaged workgroups within companies outperform groups with lower employee engagement levels, and the recent findings reinforce these conclusions at the workgroup level.

The meta-analysis study shows that top-quartile business units have 12% higher customer advocacy, 18% higher productivity, and 12% higher profitability than bottom-quartile business units. Conversely, bottom-quartile business units experience 31% to 51% more employee turnover, 51% more inventory shrinkage, and 62% more accidents than those in the top quartile of workplace engagement.

"These aggregated patterns show that engaged employees are more likely to stay with their organizations, are less likely to steal or experience accidents on the job, and are more likely to please customers and be highly productive," says Harter, who coauthored a book on employee engagement, 12: The Elements of Great Managing. "It all adds up to higher profitability, which over time, influences earnings per share."

This research into earnings per share provides powerful proof that employee engagement correlates to crucial business outcomes. Not all shareholders or prospective investors are able to study the culture of the companies they are investing in. That's why this company-level information is a valuable communication tool for company leaders to provide to shareholders and other business leaders.

|

"I think this study will have a definite impact in reinforcing the importance of studying employee engagement," Asplund says. "The linkage between engagement and earnings per share is more meaningful to some people in an organization than some of the other linkages Gallup can show them, because investor earnings are something that executives really worry about." Harter adds that while the findings don't necessarily describe the daily, specific actions a company takes to increase engagement, the findings do emphasize how important those actions are -- and how companies can substantially improve crucial business outcomes by investing in an engaged workplace.